Editorial > Do You Have Enough to Retire? Is Retirement Planning Important?

Do You Have Enough to Retire? Is Retirement Planning Important?

Dais Feature | 30/11/2020 06:00 PM

Every discussion of 2020 seems to start with a mention of the Pandemic and the ailings, now it hopefully seems to be coming to an end. While looking towards the future, a lot of businesses that had taken a hit and had slowed down their engines, almost seem to be pivoting and reimagining their business with new vigour and charging ahead.

We consitute the elemental bricks of these businesses and consequentially also are a part of the economy. As promoters, shareholders, employees, or creditors – our lives too seem to be gradually returning to normalcy after a beyond-normal 2020. As we return to work and start picking up where we left in March this year – we sat back to think about the goals that we stopped pursuing midway due to this sudden jolt by the pandemic. Now these goals seemed to have taken a new avatar – one of extra caution – that such a calamity may befall us again and it would be imprudent to not plan for a similar occurrence in our future lives again.

While we are excited about the reversal of the drop in stock markets and the fair handling of the economic situation by the Indian government during these unprecedented times, we are also conscious of the fact that this pandemic must bring in new learnings to our old goals of financial prudence and management.

We introduce a Financial Planning Series this month to address these objectives and bring in implementable perspective for our readers to gain a hold of their finances post this storm and revert to their journey of planning the financial future for themselves and their families. Some questions arise - Are today's youth concerned about their retirement? When should anyone begin retirement planning?

Financial Planner and Retirement Specialist Sparsh Kaeley guides us on an important area of our financial future – Retirement Planning this month and asks a pertinent question to provoke your thought – If you were to live healthy and long, would you have enough to retire?

The pandemic has done enough damage to all of us – more importantly to our financial plans and goals – one area that is often unplanned or under-planned for most people we know.

The pandemic has done enough damage to all of us – more importantly to our financial plans and goals – one area that is often unplanned or under-planned for most people we know.

Being a Retirement Specialist, I do tend to think about my own retirement and whether I am sufficiently covered for it, time and again. One thought that I have always retained for myself as well as for my clients is – one has to ensure that this plan one makes, either on one’s own or with professional help, has to be comprehensive and addresses all the concerns of life, post-retirement.

We thought it was a good beginning point to start with a basic checklist of things one must address in the making of a retirement plan. The criticality, mind you, of each of these is to such an extent that without these being in place, you cannot retire in confidently and in time.

It’s time now that we get on to the understandings about how to plan for what we call the Golden Years.

Obligations / Outstanding Debt/ Aspirational Expenditures

What is Debt? Any payments or liabilities due to be paid is called debt.

An obligation could include debt payable to another person or entity and could also mean a pending expenditure on your balance sheet - such as a child’s education or marriage. So, before you start counting how much money you have saved for retirement, you need to keep aside some of it for any of these remaining obligations that you may have. Apart from the necessary payments, there are also the luxury payments that we call Aspirational expenditure – such as the purchase of a luxury car, a bigger house, a holiday home or a world tour with your spouse. There needs to be funds set aside for these obligations as well as your aspirations to have an accurate estimate of where you stand in terms of the funds available for your retirement.

This basic step will leave you with a more accurate and practical number to work with and you can start planning for your retirement accordingly.

Emergency Healthcare Fund

Life expectancy has increased and is only getting better with the advancement of medical science and access to better healthcare facilities. But better healthcare comes at a cost! If you wish that you and your family should have access to the best of healthcare facilities when in need, this is an important area of focus.

W hile most of us have health insurance, we will only realize its coverage and assistance when we need to use it. The challenge with many health insurance policies is that they do not cover many pre-existing illnesses. There could be claim rejections and policy lapses due to error/non payment of premium which could leave you cover-less in the year of need. A lot of us tend to depend only on the Group Mediclaim we get from our employer – often forgetting that job changes and layoffs are fairly common now. If you quit your job supposedly at the age of 50 , getting a Mediclaim cover for yourself and your family could prove to be extremely expensive. There could be complications of pre-existing illnesses, present day health issues or family heredity that could make qualification for an insurance cover difficult then.

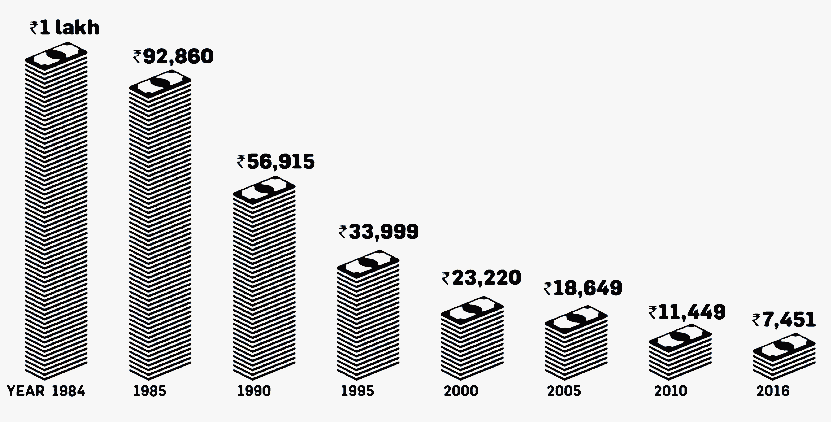

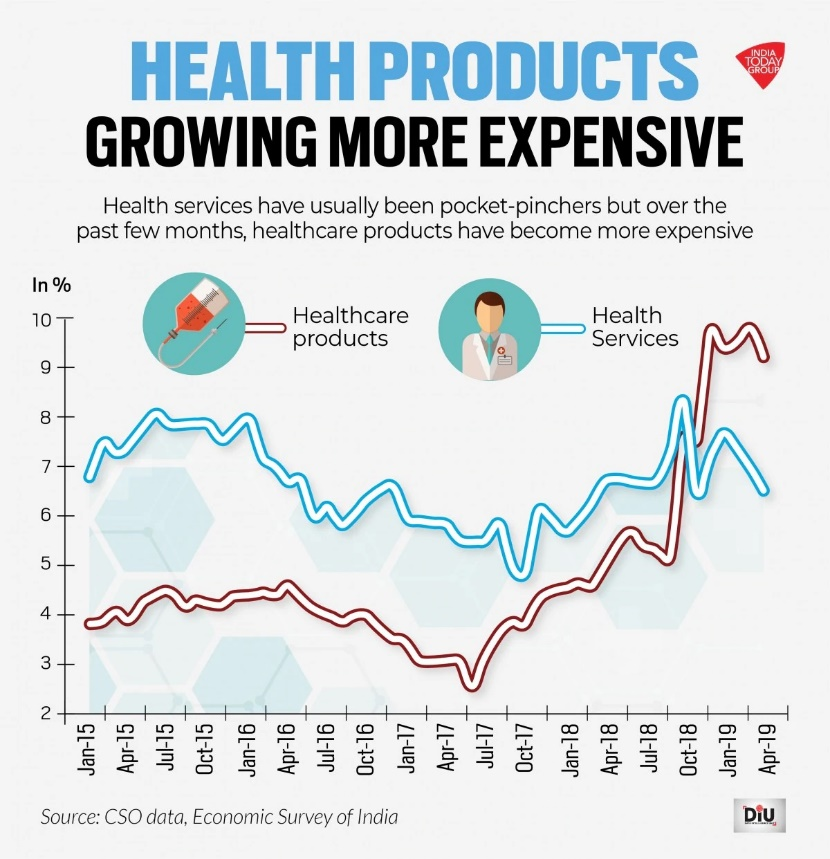

An important aspect of calculating the adequacy of your Health Insurance cover is Inflation. Healthcare or medical Inflation is higher than in a lot of other areas.

What is Medical Inflation?

What is Medical Inflation?

You may have a health insurance cover worth ₹10 lakhs, which seems adequate enough to cover most procedures today. However, in 20 years’ time, the cost of these procedures could double or even triple, whereas your Insurance cover would remain the same. As one ages, it keeps getting tougher and considerably more expensive to buy more health insurance.

Hence, it is always recommended to set some funds aside dedicated towards healthcare expenses. Ideally, these funds should be invested in a Fixed Deposit or a Debt Mutual Fund so that you have easy access to them and they can grow at a rate which is in line with or higher than inflation. For those without any health insurance, this becomes all the more important. This fund set aside will act as a backup for your Health Insurance and provide comfort in times of Emergency or unforeseen situations.

Inflation Adjusted Pension – replacement of Salary after retirement

Inflation Adjusted Pension – replacement of Salary after retirement

One of the greatest worries of most people is the discontinuance of salary once they retire – they find it difficult to accept the stoppage of this regular flow and often seek professional help very late in their working careers, to help them with this critical worry.

To be sure, THIS is the core of retirement planning. Unless one plans one’s finances in a manner that their salary is replaced with some form of regular inflow even post retirement – there will not be much peace when one reaches that particular stage of life.

Not accounting for inflation is the biggest mistake most people make while planning these cashflows. While you should invest a large part of your corpus in guaranteed/ less volatile financial products like Fixed Deposits, Annuity Plans, Debt funds, you should also invest some of it in seemingly riskier products such as direct equities and equity mutual funds, and let that money compound and generate a higher return, so that overall, your retirement corpus keeps pace with inflation.

Equities done in moderation and post understanding the risks in entirety can actually be rewarding in the long run. If you invest all your money in “safe” products (which give lower returns), at some point, you will have to cut down on your standard of living.

Taxation also is a very important consideration when it comes to investing your retirement savings. Please remember, if you wish to maintain your wealth, you need to ensure that you are generating a return which is more than inflation on a post-tax basis!

For example, consider two guaranteed return products, Product A and Product B. Product A gives you a 6% tax free return, and product B gives you an 8% taxable return. Which one would you choose? If I assume that you fall in the 30% tax bracket, your post tax return in Product A will be 6%, since it is a tax-free product, however your post tax return in Product B will be around 5.4%. It is very important to choose products based on their post-tax returns, and not their pre-tax returns!

To sum up, you need a retirement corpus with a mix of risk free and tax efficient products in order to beat inflation on a post-tax basis!

Leaving behind a Legacy

Leaving behind a Legacy

We want to live comfortable lives but as parents we aspire to leave a good sum of money as inheritance for our children so that they continue to lead comfortable or better so, lavish lives. In the endeavour of doing so, we often compromise on our own lifestyle during our working years and post-retirement. A better strategy would be to plan your legacy separately from your core retirement income generation strategy.

For example, if you were to invest just 3.5 lakhs today, it would grow to about Rs 1 Crore in 30 years (assuming a return of 12% p.a). Such is the power of compounding!! Because you are only planning for a legacy and can leave these funds untouched for a long period of time, take this benefit of compounding by working out a hybrid investment plan which includes both fixed income and equity instruments that will deliver that rate of return to you.

And of course, a by-line of this important topic is the need to have a will in place! It is very important to ensure that you have a registered will and that each and every investment you have made has the nominees updated and in synchronization with the will document. This should be done even pre-retirement in order to ensure that there is a hassle-free transfer of funds to the nominees in case of unforeseen situations.

Keeping it Simple!

Any decision you take regarding money management during retirement should be easy enough for your spouse to understand as well. Your spouse should not have any difficulty managing the retirement corpus if you are not around.

This point is especially important for men, since there is a good chance that your wife may not only outlive you, but she may also be younger than you. Thus, it’s surely is important to ensure that your spouse can manage your retirement corpus single-handedly. Retirement is not an individual decision and one must ensure that both the partners are involved throughout the process. The simpler your retirement plan is, the better. You must also remember that with age you may not be as sharp as you were before, so avoiding a complicated retirement plan is important for you as well!

10 pointers to help you navigate this path of retirement planning

- Invest your monies in assets which are relatively liquid and easy to access. Having multiple houses in different cities or countries may not be a wise idea since these become difficult to manage when one turns older and definitely become a liability for children when passed on as legacy.

- Create hybrid plans of investment which include both Fixed Income as well as Equity investments so that a healthy rate of return is generated on your retirement corpus

- Be mindful of the taxes you are paying during the growth phase of your retirement corpus. Also plan the pay-outs post retirement carefully to avoid being heavily taxed on periodic payments

- Evaluate products like pension plans and retirement insurances carefully. These often do not beat inflation unless the right options and plans are chosen.

- Keep updating your Health Insurance cover to keep it growing in line with inflation

- Keep your spouse involved in all decisions on your retirement and legacy corpus so that he/she understands why certain decisions were made and can often also provide valuable inputs to keep the plan on course

- Do not get bogged down by market swings and change the course of your retirement plan every few months. This is a long-term investment and must be allowed to gestate over a longer period of time. The compounding will kick in only after a few years of regular growth

- Keep an eye on the investments and assets chosen in your plan and maintain a goalpost to benchmark performance. Make changes as and when necessary to weed out underperformers on your assets and bring in better performing avenues.

- Create a will and register it to ensure that there is no dispute on your inheritance amongst the family members when you are not around. Maintain a copy with a trusted friend, relative or colleague so that there is backup in case the original is lost or disputed.

- Avoid exotic investments that you don’t understand and cannot explain to your family. These investments will be a part of your plan for 20-30 years till you retire and even post that once you begin consuming your retirement corpus. It should be a plan that you understand and can execute yourself if need be. Do adequate reading before investing in any instrument or asset.

In India, where each generation works first to meet their basic needs and then to leave behind an inheritance for their children, the critical period of retirement (which often lasts several years for most of us) is often missed in the grand plan. It is easy for anyone to write down a prescription for you but it is upto you to take that prescribed course with diligence and regularity. Financial security comes with practising years of discipline in saving, investing and reviewing one’s investments and the benefits of it are reaped by us in the sundown years as well as by our children on the legacy we leave behind.

The Dais Editorial Team believes this feature gives you a basic framework to begin with and could help you understand which areas you need to address as you embark on this important journey. We wish you all the best!

S P A R S H K A E L E Y is the Founder of Ortium Financial Services – a qualified Chartered Financial Planner (CFP) and Retirement Planning Expert. His family is in the business of Financial Planning and Wealth management for over two decades now. Their mission is to help increase awareness about the challenges in Retirement and help people create and execute the best Retirement plan that ensures that their investments outlive them!

S P A R S H K A E L E Y is the Founder of Ortium Financial Services – a qualified Chartered Financial Planner (CFP) and Retirement Planning Expert. His family is in the business of Financial Planning and Wealth management for over two decades now. Their mission is to help increase awareness about the challenges in Retirement and help people create and execute the best Retirement plan that ensures that their investments outlive them!

His thoughts can further be accessed Here.

You were reading a Dais Editorial©2020